For PayID & PayTO

UX Guides

Learn best practice by reading our detailed UX guides and reviewing how our products are used in common Use Cases.

PayID

- Azupay Merchant UX guide

- NPP PayID Guidelines 3.0.1

- Marketing Kit

- Click-through Payment Demonstration

PayTo

Use Cases

For businesses who accept ongoing payments into a digital wallet/account

Our offering allows your customers to pay via the same PayId each time, which can be saved to their online banking platform. Whenever your customer needs to add funds and make a payment to you, the PayId will always be available for them to do so.

As each payment is made, we provide alerts to you so that funds can be reflected in your customers account, enabling them to transaction.

In our technical documentation, this is called a Static-Open PayId. Click here to learn more.

Payment Experience

Jessie logs in to her investment platform, InvestApp.

-

She decides to add funds to her account, and selects PayId as the payment method. She is presented with InvestApp’s static PayId, which is based on Jessie’s account number:

-

IA999003@InvestApp.com.au.

-

-

Jessie copies the unique PayId, switches to her mobile banking application and uses the Pay Anyone feature, paying to an email PayId.

-

Her banking app resolves the PayId and displays [InvestApp Pty Ltd - Deposits], and Jessie proceeds to pay send $500.00.

Once the payment has been received, Azupay then notifies InvestApp, who in turn makes this available for Jessie to invest when she logs into the InvestApp app again.

For businesses who issue recurring invoices, bills or payment requests with varied amounts

Our offering allows your customers to pay via the same PayId each time, which can be saved to their online banking platform. When the next payment is due, we simply update the information attached to the PayId, so that when the PayId is verified, the latest due amount and description is displayed.

In our technical documentation this is called a Static-Recycled PayId.

Payment Experience

Jesse signs up to a new electricity provider (ABL) and selects to use PayID to pay her quarterly bills.

-

When the PDF bill is generated and sent, she is provided with a PayID to make her payment to.

-

Upon entering the PayID into her banking app, the ABL name and amount appears. Jesse then completes her payment to the specified amount.

-

Once the payID has been paid or expired, it becomes deregistered so it cannot accept any more payments. Before the next quarterly bill is due, ABL will reregister the same PayID with a new payment amount.

The next time Jessie needs to pay her bill and enters the PayID into her banking app, the ABL name and new amount will appear.

For businesses who offer one-off purchases via eCommerce or Point of Sale

Our offering allows your customers to pay to a unique PayId. For each transaction, we generate a unique payId and when the payment is completed, we deregister this PayId so it can no longer accept payments, allowing for straight through reconciliation of each payment based on the unique PayId.

In our technical documentation this is called a Single-Use PayId.

Payment Experience

Jesse does her online shopping and is ready to checkout.

-

She selects PayID as the payment method and is presented with a unique PayID.

-

Jesse uses her online banking app to complete the payment.

-

When she returns to the eCommerce website, it has been refreshed to confirm the order is completed.

In the background, the PayID is deregistered and will cannot accept anymore payments

For government bodies looking to accept secure payments for online fees, renewals and licensing payments:

Our offering allows your customers to pay to a unique PayID. For each transaction, we generate a unique PayID and when the payment is completed, we deregister this PayID so it can no longer accept payments, allowing for straight through reconciliation of each payment based on the unique PayID.

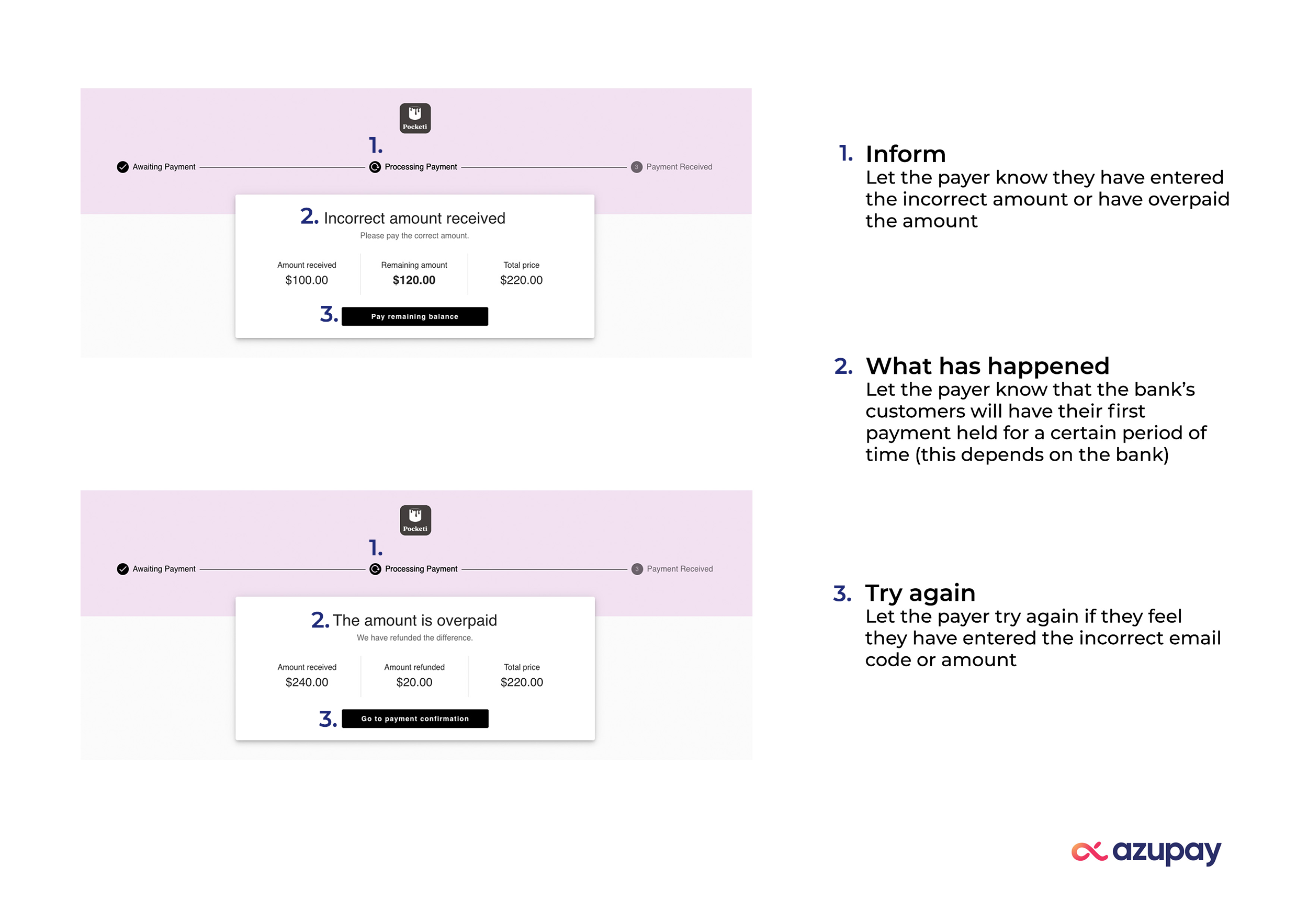

There are also various configurations to manage the payments experience, such as rejecting payments under and over the specified amount, or accepting an overpayment but refunding the difference. In our technical documentation this is called a Single-Use PayID.

Payment Experience A

- Jesse decides to go fishing this weekend and understands she requires a fishing license

- She logs in to the Service NSW app to purchase a fishing license for the day

- A unique PayID for this transaction is presented. She copies this, logins in to her bank account and makes a payment to the PayID.

- Jesse returns to the app and sees the screen has been updated, as the payment has been received in real time. She scrolls down to find her fishing license.

Additionally, some government bodies may be operating a wallet-type top-up of accounts such as e-toll. Our Multiple Payment PayID offering allows a customer to have one PayID that they always pay to for a wallet or pre-paid payment experience. In our technical documentation this is called a Static Open PayID.

Payment Experience B

Jesse has just purchased a new car and requires a toll account, given she frequently takes a toll road to work.- She creates her account, registers her vehicle details and decides to use PayID to top-up her account (this could be their customer number 981132@governmentbody.gov.au).

- Jessie is then presented with a PayID which is unique to her, and can be saved in her banking app. She is able to make payments to this account any time to top up her account.

Our offering allows PayID so it can no longer accept payments, allowing for straight through reconciliation of each payment based on the unique PayID.

There are also various configurations to manage the payments experience, such as rejecting payments under and over the specified amount, or accepting an overpayment but refunding the difference. In our technical documentation this is called a Single-Use PayID.

Payment Experience A

- Jesse decides to go purchase some USD for her upcoming holiday.

- She logs in to her Forex App to order some cash and is happy with the exchange rate.

- A unique PayID for this transaction is presented. She copies this, logins in to her bank account and makes a payment to the PayID.

- Jesse returns to the app and sees the screen has been updated, as the payment has been received in real time. She can now head to her selected branch to pick up her cash.

Additionally, some remittance companies may be operating a wallet-type top-up of accounts such as a Global Currency Account or Travel card. Our Multiple Payment PayID offering allows a customer to have one PayID that they always pay to for a card. In our technical documentation this is called a Static Open PayID.

Payment Experience B

- Jesse has just purchased received her Global Currency account card from Remitters Express, as she is travelling to multiple countries on her holiday.

- She is presented with a PayID to top-up her Australian Dollars into the account.

- Jessie can always pay to this PayID which is unique to her, and can be saved in her banking app. She can top-up her card at any time.

- Remitters express then allows her to spend foreign currency abroad by dynamically converting her Australian Dollars in the account.

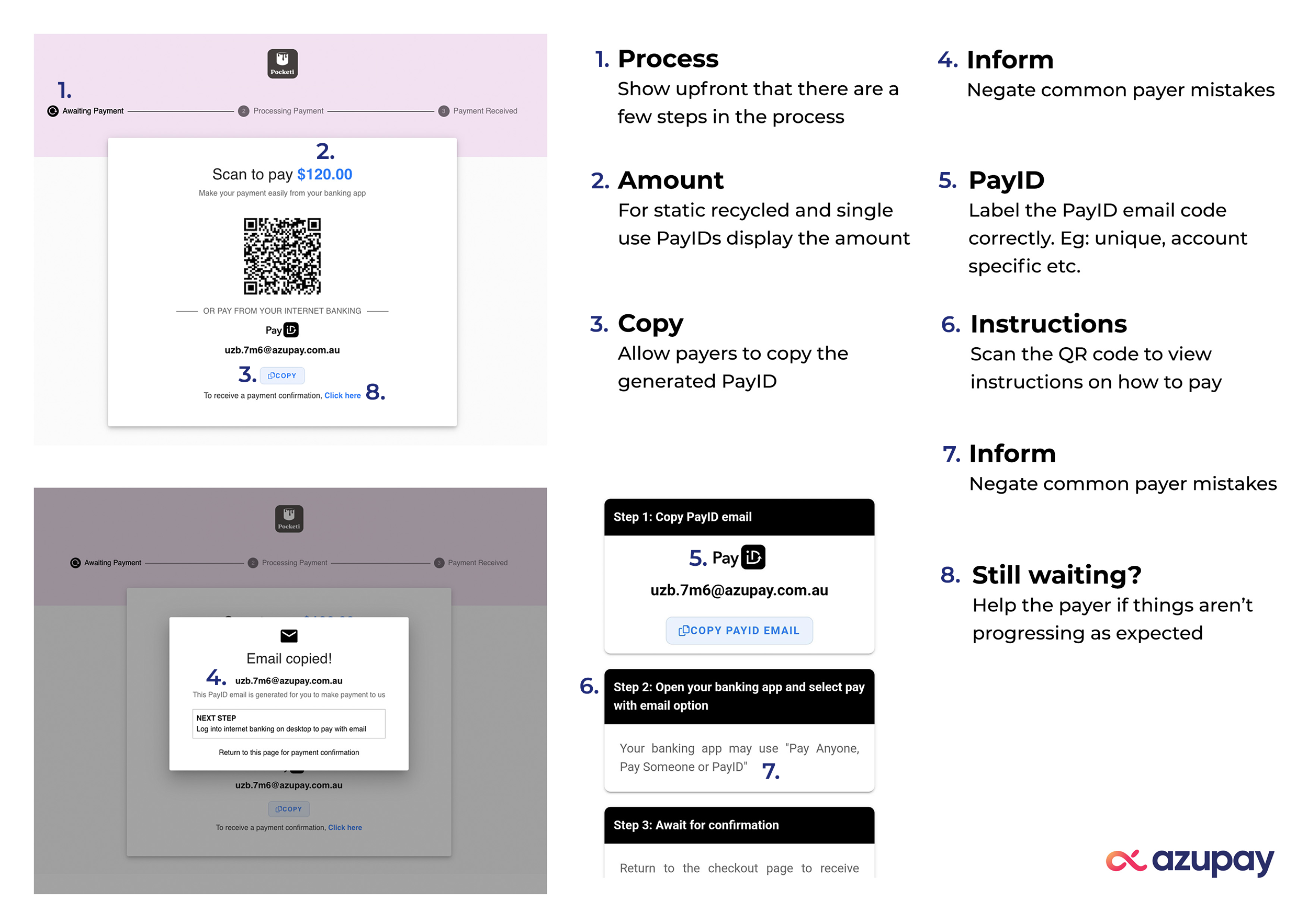

Payment Widgets

Decide which integration method to use

Our out-of-the-box payment widget enables instant PayID payment functionality to your checkout flow. Future proof your customers' payment experience by integrating once and all future upgrades become seamless and instant.

Azupay's extensive user research ensures we provide the ultimate user experience for you and your customers.

Use Azupay's Optimised UX

Option 1

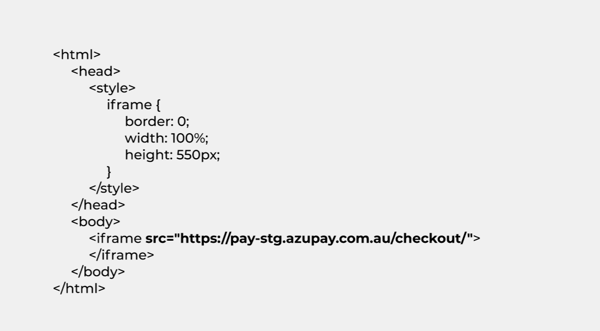

IFRAME Integration

Azupay provides a simplified integration so you can focus on your customers.

Utilising the Azupay APIs, generate the payment widget URL and embed as an IFRAME into your existing checkout.

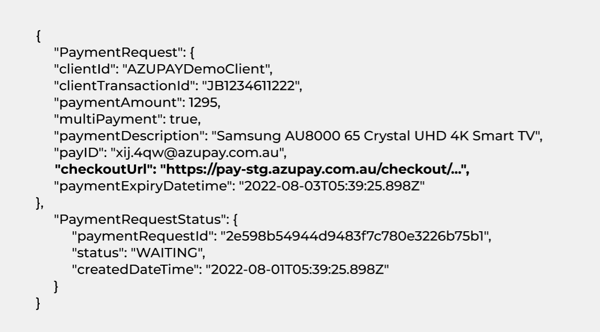

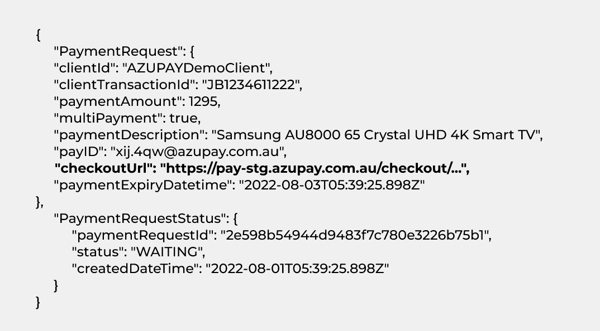

Payment Request API response will return the checkoutUrl attribute

Use the checkoutUrl attribute as the source for the iframe.

Option 2

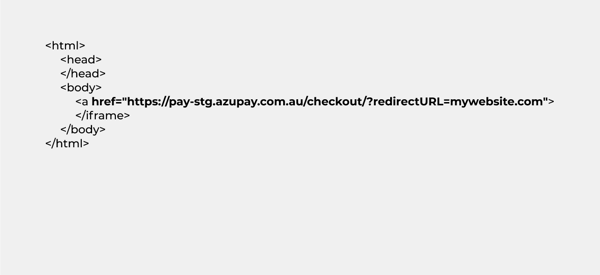

REDIRECT Integration

Redirect to the Azupay payment widget and return to your checkout when payment is complete.

Payment Request API response will return the checkoutUrl attribute

Use the checkoutUrl attribute with the direct query string parameter

Build Your Own UX

CUSTOM Integration

Azupay provides recommendations to suit your business requirements.

Create a user interface specific to your checkout and integrate with our API's directly.

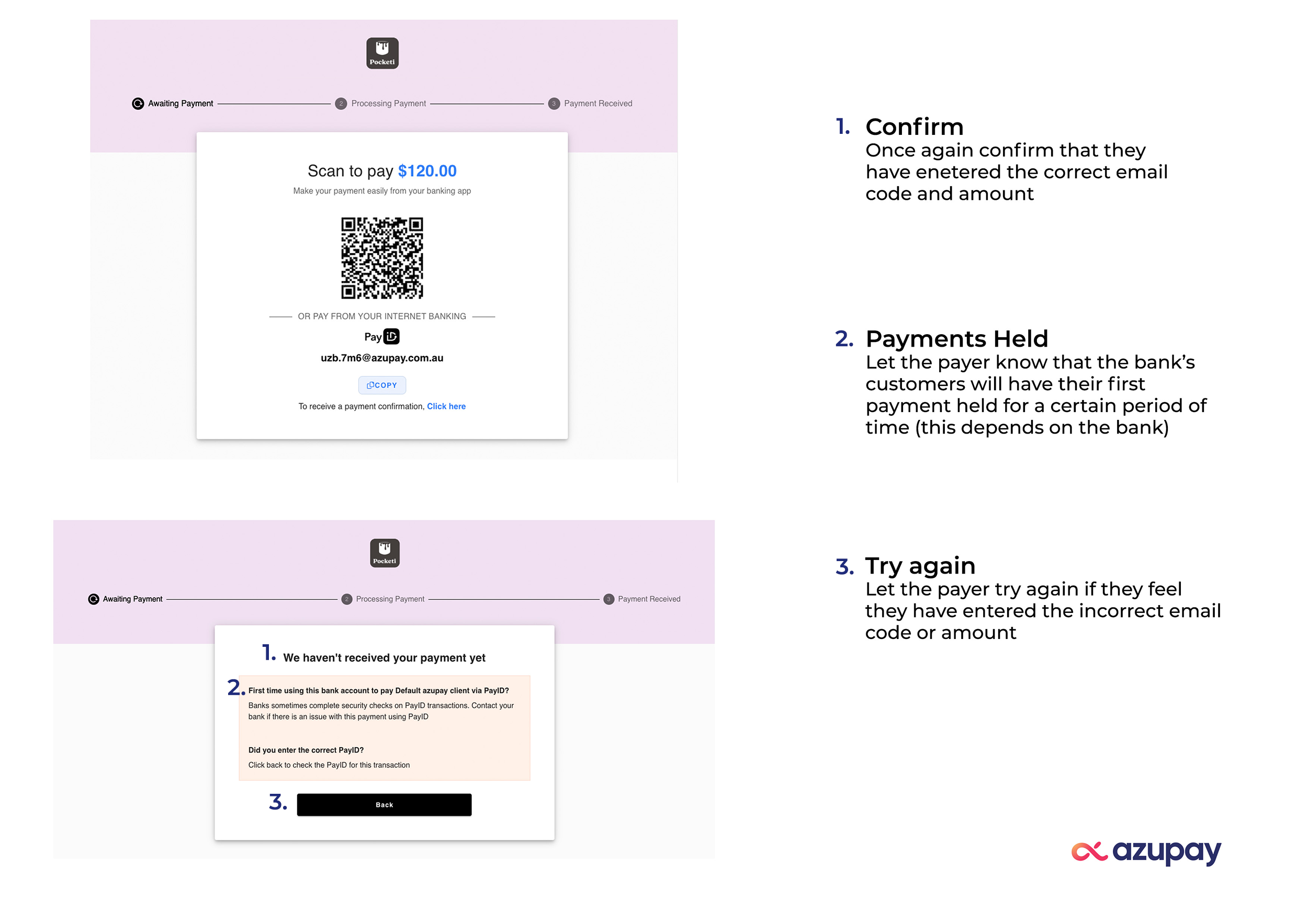

How to make a payment

View the demonstration videos below to see how to make a PayID payment.

No video selected

Select a video type in the sidebar.